2023, a year in review

We entered 2023 content with how we handled the 2022 crypto bear market (our maximum drawdown then was less than 4%). When the markets turned in January 2023, in typical fashion, momentum models were slow to catch the reversal. Sudden price spikes are notoriously difficult to capture for momentum models, especially when in the preceding periods the price moved sideways or downward.

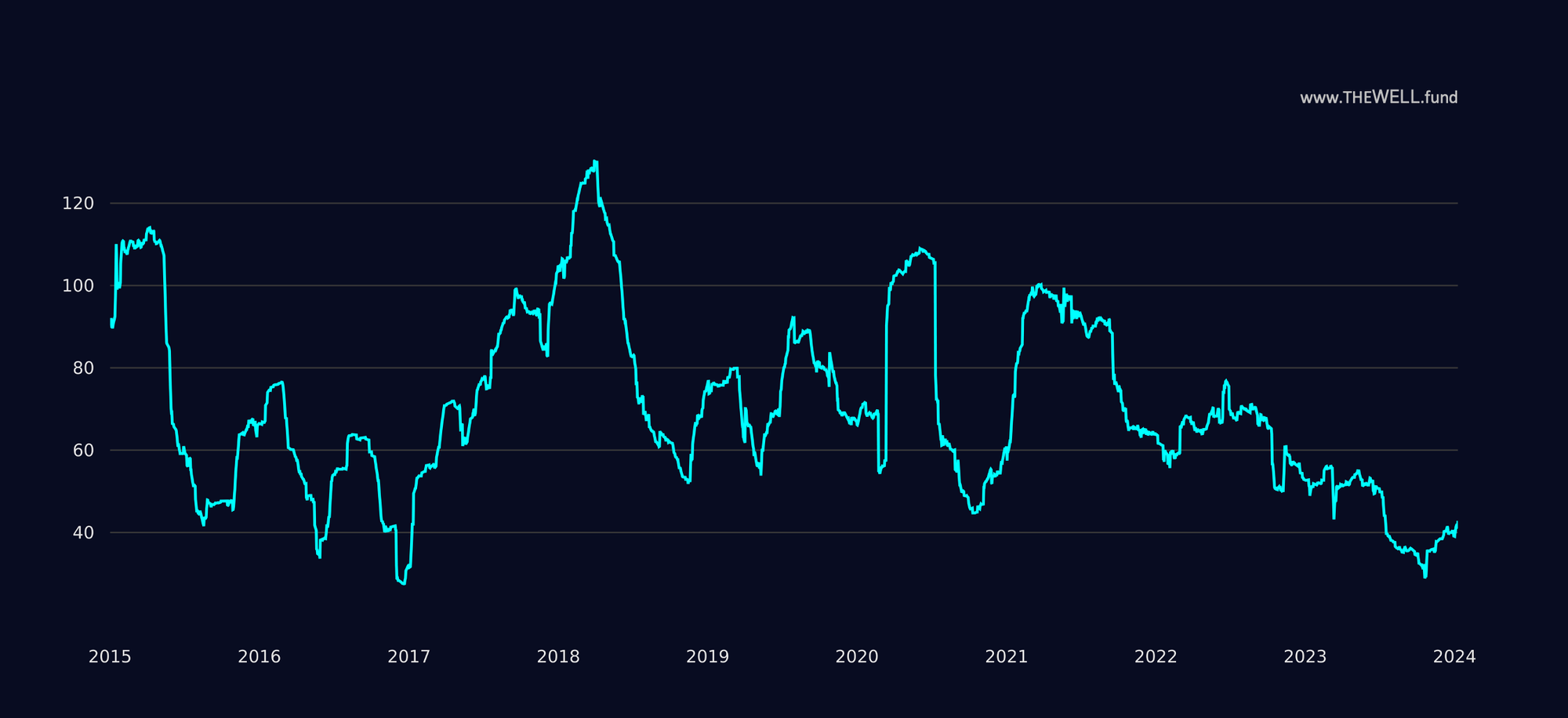

In the first half of the year, as already customary when coming out of a bear market, investors once again realized that crypto is here to stay. 2023's crypto market performance was primarily driven by four price jumps - January, March, June and October as highlighted by the rectangles in the graph below.

In January 2023, our models’ trend conviction level was still very low as we came out of the major bear market phase of 2022. After a strong bear market, models tend to be cautious to build conviction and do not switch into a bull regime easily until a clear trend is established.

Trends tend to be strong when prices rise consistently while volatility rises less. The first three of the above price moves were spikes that did not last, and markets either stagnated or sold off mildly afterward. At each spike, our models gained slightly more conviction, giving us more exposure in the subsequent stagnation or correction. The summer months, characterized by an absence of volatility and liquidity and reaching near all-time volatility lows, were especially challenging for our momentum models.

Starting in October (green rectangle), however, things began to turn. Volatility is a major input into any sophisticated quant model, as it defines the opportunity a model can capture. While January to March looked promising at first, until October, volatility did not prove to be a driving force in the market. In October, the market changed significantly. As in the previous spikes volatility started to increase, but this time, the trend persisted. Prices did not go sideways and there was no sell off. Finally, a trend has formed and persisted, and our models were able to capture large portions of the moves while reducing risk whenever the price moves started to look less promising.

When we zoom out and take a multi-year view, it becomes clear that based on volatility we are still in the very early stages of a potential crypto bull market.

As we continually strive to improve our models, despite the unfavorable market conditions, we added major upgrades in 2023 and already in 2024, increasing our signals to a total of 21 and improving our models’ ability to react dynamically to sudden price spikes. Among many improvements, we added parts that derive information of relative performance against other assets to move faster without a long history of good trends before models get confident.

Improved signals and portfolio allocation methods would, in retrospect, have generated outsized returns in 2023. In Q4 we were able to capture the changed market environment starting in October and with more signals in the research pipeline we are looking forward to a very profitable 2024.

This blog post is shared with the intention to provide educational content, general market commentary or company specific announcements. It does not constitute an offer to sell or a solicitation of an offer to buy securities managed by The Well GP.

Any offer or solicitation may only be made pursuant to a confidential Private Placement Memorandum, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the fund.

Past performance is not necessarily indicative of or a guarantee of future results.

The Well GP makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal, tax advice or investment recommendations.

This publication may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward looking statements are based on the management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. Although the management believes that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these expectations will prove to be correct.