Avoiding the Cliff: Steady Wins the Race

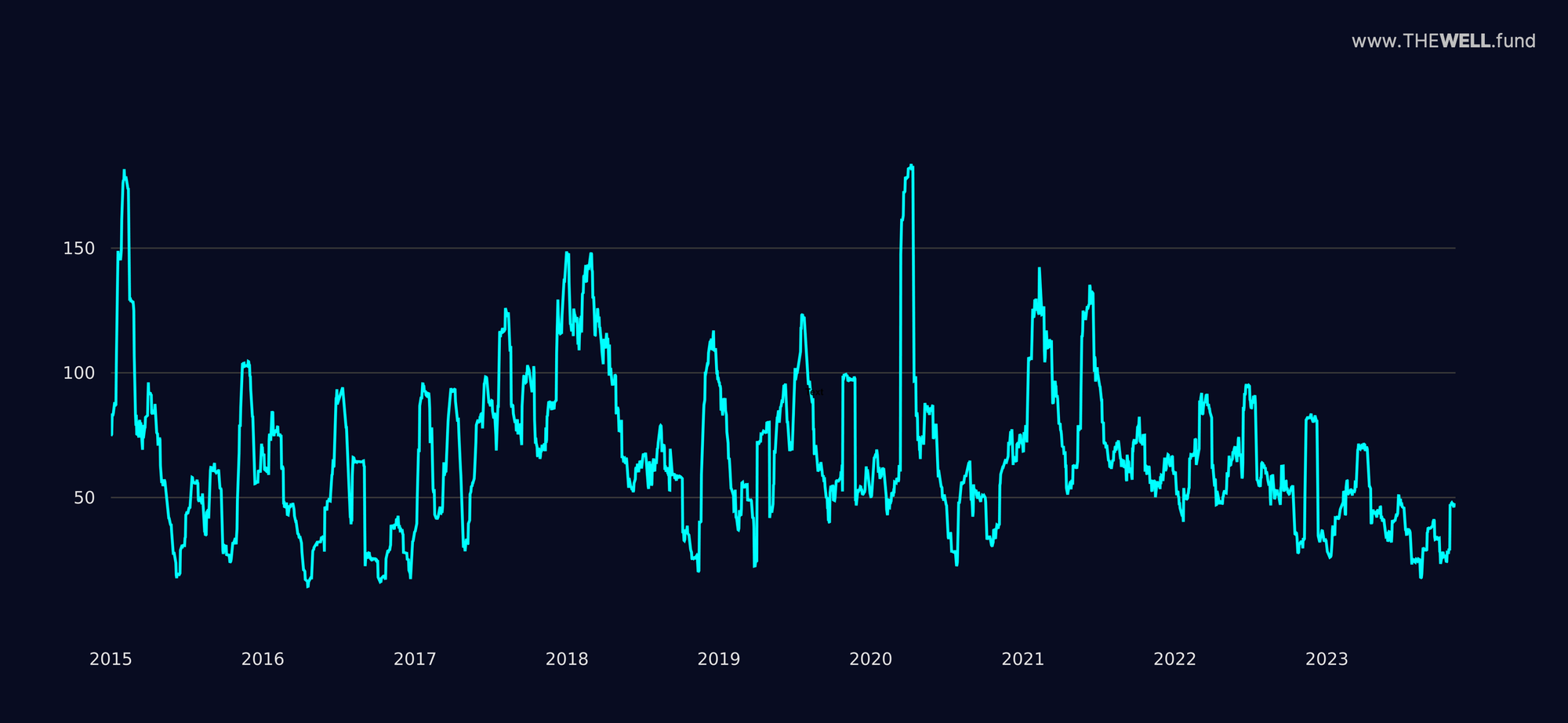

A slight pickup in Bitcoin (BTC) volatility last month created a favorable environment for momentum models to reap the gains. Nevertheless, volatility remains low compared to historical figures. We are looking forward to further volatility and the performance of momentum models in their native environment.

As we may be approaching a market phase marked by rapid price fluctuations and a significant amount of FOMO (investor’s fear of missing out), we would like to draw attention to an important phenomenon that may be frustrating to observe in a quant portfolio, yet can prove beneficial to establish a comprehensive understanding for long-term wealth gains.

Imagine that you are participating in a race and Bitcoin is a competitor who had an early start. You are the quant model that waits until the competitor with the advantage is already accelerating before determining whether it is worth embarking on a run of your own. In our metaphor, the race represents the market activity and the running speed represents the trend.

Referring to the markets, if the price of the underlying asset increases by 10% from $100 to $110, it would be comparable to the other racer sprinting ahead. The quant model, which is designed to spot patterns or trends in asset prices, will not start "running" until it identifies that a trend is occurring. Therefore, there is a delay before the model increases exposure to the asset.

The delay of the quant model's reaction is the reason why its returns often appear lower compared to the asset in the short term. When a trend is spotted and a decision is made to buy or sell, the asset has already run some distance, meaning that the investor using the quant model misses out on the initial increase.

To put it simply, the time lost at the start, when the asset first began to rally, reduces the overall potential gain from a rising trend, as the quant model inevitably misses part of the initial run. As a result, during this phase, the quantitative model's returns tend to be lower than those of the underlying asset.

Markets have a beneficial phenomenon known as compounding, which is essentially earnings on earnings. However, since the quant model entered the trend later than the underlying asset, the overall compounding effect for the quant model is lower in the short term. Nonetheless, in the long term the quant model uses the same compounding mechanism to its advantage to win the race.

How can the quant model come ahead despite the above circumstances?

It is important to remember that quant models are designed to control risk and provide stable returns, instead of simply chasing after the highest possible gains. Going back to the race metaphor, the sprint may be going well for the underlying asset, our front-runner, sprinting ahead rapidly. However, every race has an end and eventually the underlying asset will experience a fall. There is no finish line in the markets, but there are cliffs where asset prices can drop suddenly and steeply. This is analogous to our leading contender slipping just before reaching the finish line. Investors who are solely relying on the asset's performance will end up suffering from the sudden fall. This is especially true for highly volatile assets like BTC, where drawdowns of 50% or more are not unusual after a bull run.

Herein lies the skill where quant models can provide unique value. The same logic the models apply to finding a rising trend is also used to predict a decline. If a decline or "cliff" is approaching, the quant model can start minimizing its exposure. It is like seeing that our front-runner is going to trip and deciding to slow down. Our models have been able to avoid such cliffs, even in sudden circumstances such as the FTX fallout and the USDC depeg.

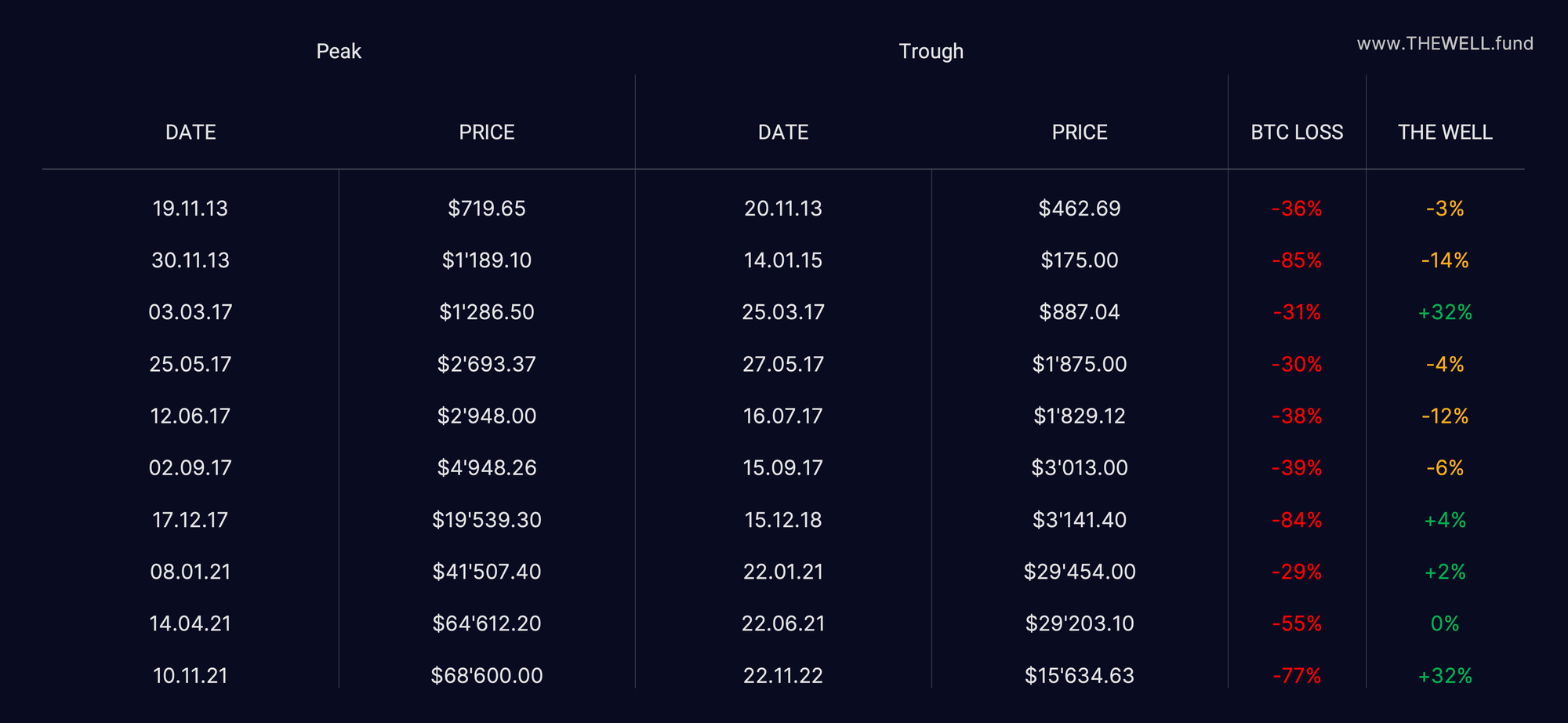

* The peak to trough calculation was made using data going back to 07.10.2013. Due to non-existence of market data for some signals currently deployed in our portfolio, simulated returns prior to 2021 were calculated using only a subset of our current models for which data was available. The same portfolio allocation mechanism that is currently deployed in the fund for the full suite of models was used. Trading cost of 5bps and a 3-hour delay for intraday trade execution to mimic a real-world scenario were assumed. The calculations were done on a 1h VWAP price that would have been obtainable on Binance perpetuals. The data does not include operational expenses, management, or performance fees.

As the table above illustrates, our models can protect gains before the underlying asset experiences a decline and avoid major losses. This allows the models to start compounding on a significantly higher level in the next run. This enhancing while mitigating effect makes quant models a desirable strategy, as they help maintain a balance between risk and return. In the race metaphor, a quant model might finish a little slower overall, but is more likely to finish the race safely, without injuries and will have a significant head-start in the next race to the top.

While even a sophisticated quant model might not grab the immediate gains from a rallying asset as quickly as other strategies (like e.g. buy and hold), it provides an advantage by reducing exposure when the asset's trend is about to end or reverse, preserving the gains and minimizing potential losses. This is a great way for investors to dodge the metaphorical cliffs in the market, thus ensuring a safer and smoother financial journey.

Of course, not every quant model is created equal, which is why our models undergo extensive testing using a variety of market data and robustness tests. You can read more about our process here.

On the broader macro level, we have observed a noteworthy pattern that has been occurring since the beginning of the year. It appears BTC and Gold are attracting safe-haven flows, reflected in the up moves, as well as in the reallocation of assets from equity markets. This is a significant departure from BTC’s previous tendency to have a technology stock beta, suggesting a potential decoupling from previous correlation patterns.

As usual, we welcome any thoughts, feedback and questions and would be happy to schedule a call to discuss the above in more detail.

This blog post is shared with the intention to provide educational content, general market commentary or company specific announcements. It does not constitute an offer to sell or a solicitation of an offer to buy securities managed by The Well GP.

Any offer or solicitation may only be made pursuant to a confidential Private Placement Memorandum, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the fund.

Past performance is not necessarily indicative of or a guarantee of future results.

The Well GP makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal, tax advice or investment recommendations.

This publication may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward looking statements are based on the management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. Although the management believes that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these expectations will prove to be correct.