Momentum strategy evaluation guide

The crypto markets have have started the new year with a bang and we would like to take the opportunity to offer a framework for evaluating momentum strategies.

This past year was marked by a massive leverage unwind (Terra/Luna, 3AC, FTX) and the vaporisation of paper profits. We are pleased to report that our crypto learnings since the MtGox days of 2012 combined with our institutional experience kept us out of trouble. Still, we increased our internal risk monitoring and our models got battle tested. We feel confident to navigate any potential contagion which may lie ahead and are thankful for the opportunity to demonstrate our robustness to investors.

We expect a significantly more favourable trading environment for the coming year. Trading volume and volatility were challengingly low last year. On the positive side, many bad actors have been eliminated, and allocators are gaining interest again to further increase their crypto exposure. We already see this in the increase in crypto market cap and volatility. If this development continues, we anticipate a very positive year ahead.

That being said, with our multi strategy approach of trading market neutral and momentum models, we continue to feel very confident no matter the environment. To shed some light on how to evaluate momentum strategies, we would like to offer the following guide.

Momentum Allocators Dilemma

Allocating money to different hedge funds is not easy. Despite the public’s perception of hedge funds as a homogenous group, there are numerous different styles, with significantly different risk and return profiles. Taking a one size fits all approach to different strategies/styles may be tempting, but certainly not viable. For instance, Sharpe ratios of intraday trading strategies should be vastly higher compared to traders using a daily interval for trading signals, simply due to mathematical properties. The intraday strategy could still have significant blow-up risk or long losing periods, even though historical returns and Sharpe ratio looked great. Evaluating a global macro hedge fund is not comparable to a market making strategy, and so forth. We could have a philosophical discussion on different styles all day long, however in this post we would like to highlight a few key properties of momentum based strategies. We are fully aware, that “momentum” may not have a single definition, so we explain what to expect from an archetype momentum strategy.

Momentum strategies require specific parameters/knowledge to evaluate. In any given market or time period, the best-looking managers might be the worst. In the following text, we would like to comment on two things. Firstly, why that is and secondly, how to increase the likelihood of selecting a successful manager. There are of course multiple other dimensions when evaluating a fund, like execution engines, team, funding and fee structure, but today’s post is limited to a conversation about robust performance, or choosing true momentum funds.

As a quant manager that incorporates momentum in their strategy (even though we also add beta neutral and other signals), we have extensive experience in evaluating momentum signals.

Momentum Properties

Before we dive into further detail, let’s highlight a few common assumptions about statistical properties momentum strategies should have. A high return over a given period with low volatility describes a trend. The higher its volatility relative to the returns during that period, the higher the uncertainty of that trend. Therefore, a strong trend can be defined as the ratio of returns versus volatility, or the Sharpe ratio. As momentum can exist in both directions, very negative and very positive, the property of a trend becomes the absolute Sharpe ratio (a very negative Sharpe describes a strong trend and so does a very positive Sharpe). Therefore, we can derive the assumption, that the higher the absolute Sharpe ratio of an asset, the higher the expected return of a momentum strategy/manager should be. In low Sharpe environments a momentum manager should significantly underperform and vice versa. As time in a market captures a risk premium, a convex payout should be expected of the overall Sharpe in a given period. For instance, in a prolonged bull market, the Sharpe ratio of a momentum strategy should approach the Sharpe of the asset, but will be below that value, until the turn of the trend. At that point the capabilities of the momentum strategy should increase performance against the underlying asset. Momentum will therefore always underperform compared to the underlying asset in a given trend period and only outperform over the long run, if opportunities to capture parts of the absolute Sharpe ratio arise.

Underperformance as a Sign of Good Risk Management: Why You Shouldn't Chase Performance

The drive to optimise for the best is innate to human beings. Some of us are more reasonable and look for the best price for value or some other metric. When it comes to asset or fund performance though, we rank from top to bottom. If we are one of the more reasonable types, we learned, that a high Sharpe with some volatility is already a better ranking parameter. We argue however, that even that approach can distract and lead to unsatisfying results.

High performance in a bull market should be expected by every manager. Ideally however, a momentum manager should significantly underperform in a strong bull market.

Timing the market is exposure to a risk premium for a favourable period of time. Every signal that tries to capture trend, can’t predict a trend but only follow it. Hence, trend-following. Having less exposure to a risk premium (e.g. market returns in any given period) in a strong uptrend will reduce the returns of such approach against the underlying asset. The outperformance only happens, if the bull market ends and the trend-following approach keeps one out of the drawdown.

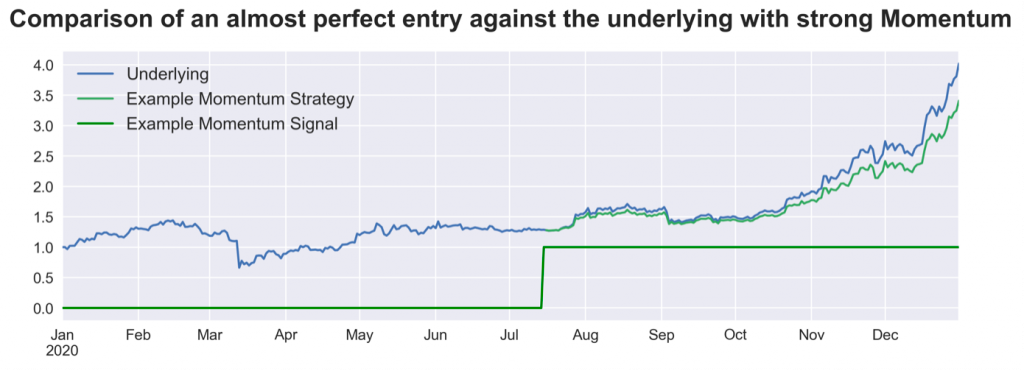

As the plot shows, even when classifying a trend reasonably well, the market returns exceeded the strategy’s returns. The compounding of returns at a stage where the underlying already gained some traction significantly reduces overall performance. This example demonstrates the convexity of the return profile of momentum against their underlying asset.

Ideally, a manager is in a trend within the first few phases and out before everyone else. Hence if he does not have perfect foresight, by definition, he will underperform just because he has less exposure to the market/risk premia. Having more performance on a risk adjusted basis than the underlying asset can be a red flag telling you, that the underlying returns are not reliably pure momentum, but either something else or to a large extent mixed with something else.

Testing the Robustness and Resilience of Your Portfolio Managers: A Simulated Approach

Making sure quantitative managers have robust signals requires some know how. It’s close to impossible to get a full view into a manager’s signals (for good reason) or to monitor changes to the range of signals used for trading. An approach we use and recommend to vet strategies and managers alike is an agnostic robustness test. Robustness can be defined as a constant low variance behavior of strategies (Bailey, Borwein, De Prado, Zhu (2014)).

To visualise robustness without having a manager give away his secrets, we use the following approach:

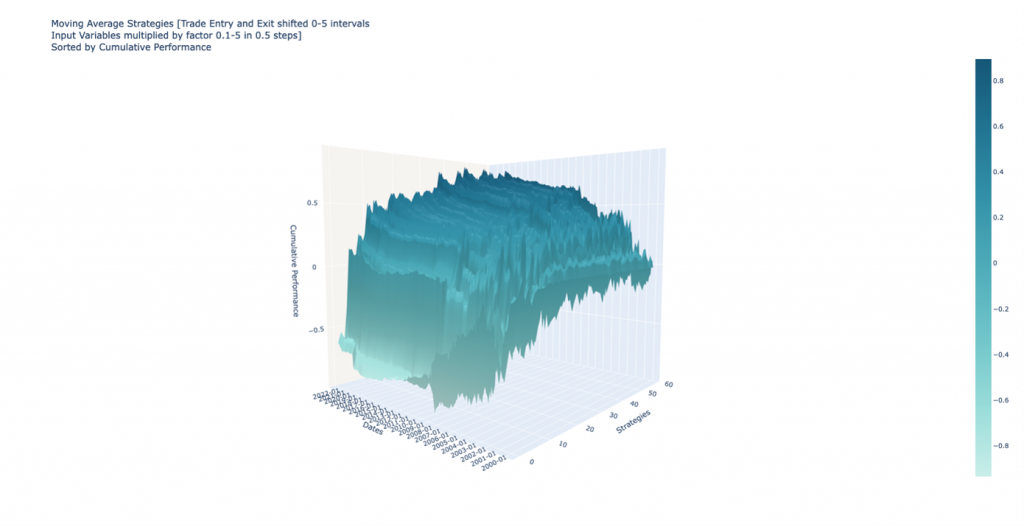

Imagine you are trading a moving average strategy that goes long an asset if the price is above its 200-day moving average. The only variable in this strategy is the 200-day lookback window. Assume we are not aware of this fact, but we would ask a manager (or calculate it for our own strategies) to run a simulation where we multiply each variable in this portfolio by a factor of 0.1 to 5. The strategy therefore would have a lookback window between 20 and 1000. A common assumption we would test simultaneously is, shifting trade entry and exit. This way we make sure, that strategies are not exactly dependent on exact execution and do not fall prey to look ahead biases in the testing. Such method of testing does not work for every type of strategy, but for momentum managers, it should be straight forward.

The results are shown below:

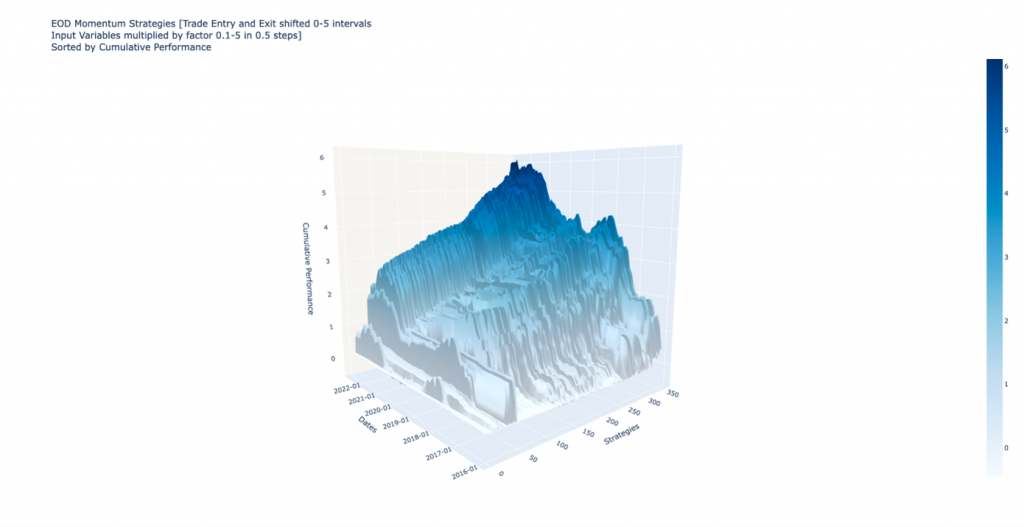

As one can clearly see, the different variables have a significant impact on the overall performance of the portfolio. While some parts of the distribution are fairly positive, others are disastrously bad. The above strategy for example should be discarded. Below a robust signal for comparison:

It’s easily recognisable, that some variance still exists due to the large expansion of initial variables, but almost all strategies are still positive, and the overall behavior is still the same.

This approach can be expanded to asking e.g. crypto managers to run the exact same test on traditional assets like bonds, commodities or equities. The results will obviously differ, because of different properties of the return series, but this method should still be able to capture trends. We cover this topic in more depth in this blog post.

Highly Correlated Momentum Strategies: A Blessing and a Curse

Due to the nature of momentum, strategies capturing a trend are all looking for the same part of a distribution. Some might be faster, more cautious, slower, or more aggressive. But ultimately, everyone is chasing the same elements of a time series. Therefore, successful momentum managers (i.e. true alpha generators) should be highly correlated in the same asset class. For example, a fund that is trading only momentum in crypto, should be fairly correlated to another fund, that does the same. Nuance can certainly be added via different risk parameters or thresholds, but true differentiation can only accrue if the managers invest in different styles or asset classes. This has two implications. Firstly, it makes life easier for an allocator that has already selected some robust momentum managers. Secondly, chances are high one does not need to look for new managers that often, which makes life harder for hedge funds that offer pure momentum strategies (which The Well is not, as we also deploy other strategies).

Conclusion

- Momentum is different than other styles, treat it only in comparison with other momentum managers/strategies.

- Diversification happens via different strategies/approaches or asset classes. Most successful momentum managers that are playing in the same asset class should be correlated – which is a good sign if their attributes meet the properties of a momentum style.

- Underperformance against the underlying asset, to a degree, is a good sign in a bull market due to the definition of “following” a trend, not predicting it.

We can go into significantly more detail on each topic and are happy to continue the conversation. If we can help make better decisions, feel free to reach out to us. We hope to add to the conversation and highlight important questions to managers and allocators alike.

This blog post is shared with the intention to provide educational content, general market commentary or company specific announcements. It does not constitute an offer to sell or a solicitation of an offer to buy securities managed by The Well GP.

Any offer or solicitation may only be made pursuant to a confidential Private Placement Memorandum, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the fund.

Past performance is not necessarily indicative of or a guarantee of future results. The Well GP makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal, tax advice or investment recommendations.