Record Performance, Positive Convexity

February was our best month since going live. That being said, on an annualized basis, March so far is also going well. What is more, the compounding effects of monthly returns become especially strong when performance is high, and should become even more pronounced over the coming quarters and years.

Making outsized returns during a crypto bull market is exciting. However, it is even more exciting and comforting when one does not have to be afraid of the inevitable down turn or temporary corrections. Our confidence to handle such scenarios successfully, is based not only on having navigated the bear market of 2022 without losses and the FTX crash with slight gains, but also on having yet again improved our models significantly. Our latest improvement integrates elements that should reduce our drawdowns by about 1/4 in magnitude, providing additional downside protection whilst capturing convexity.

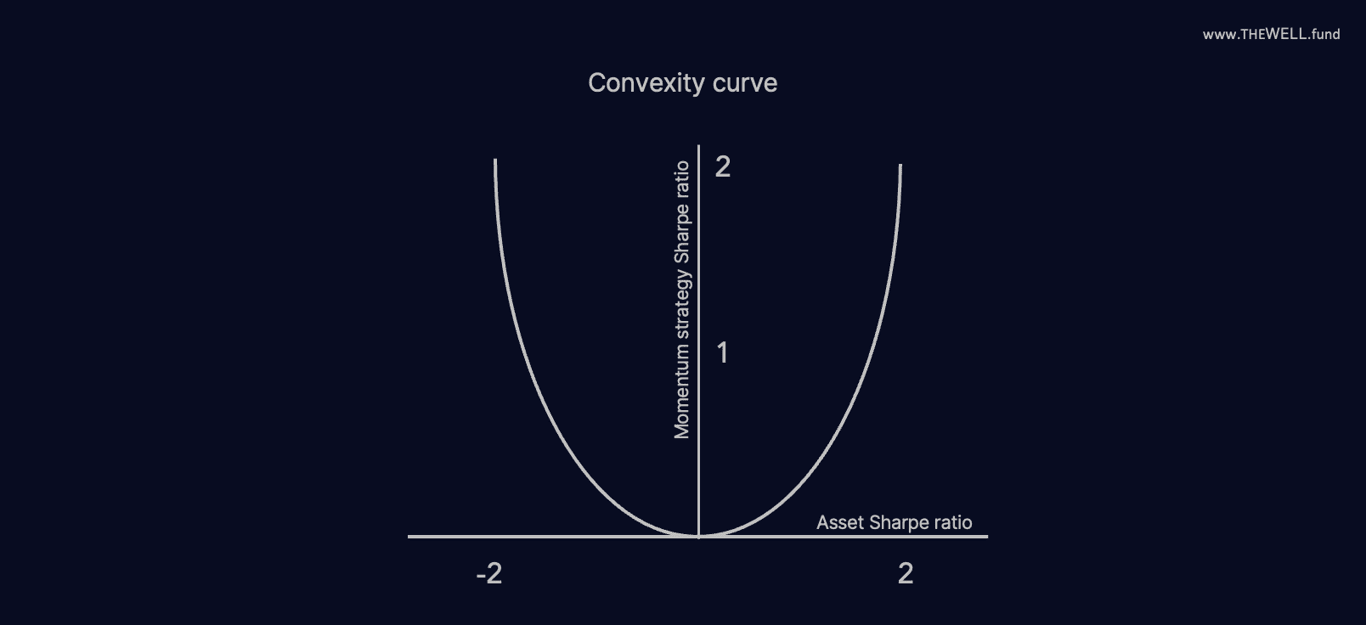

Convexity, in our case, is the non-linear relationship between an underlying asset and the fund’s returns. Ideally, a fund manager implementing a convexity strategy should profit exponentially in very negative or very positive market environments compared to his average performance when the markets are calm. The improvements to our strategies we had implemented in Q4 are paying off by capturing convexity very effectively.

In 2008, when Nassim Taleb and Mark Spitznagel made their prominent appearance in the broader financial world, funds that targeted convexity were all over the news. These types of funds greatly profited from the near meltdown of the financial system. Similarly, they once again broke records in March 2020 as the pandemic panic unfolded, with some claiming a 4144% return in the first quarter of that year.

Momentum funds are less extreme in their payoff structure at the outer edges of the convexity curve, but therefore they do not require black swan events and expect returns to be more frequent and steady. As such, they share a similar return profile to long volatility traders and profit primarily when assets have high positive absolute Sharpe ratios.

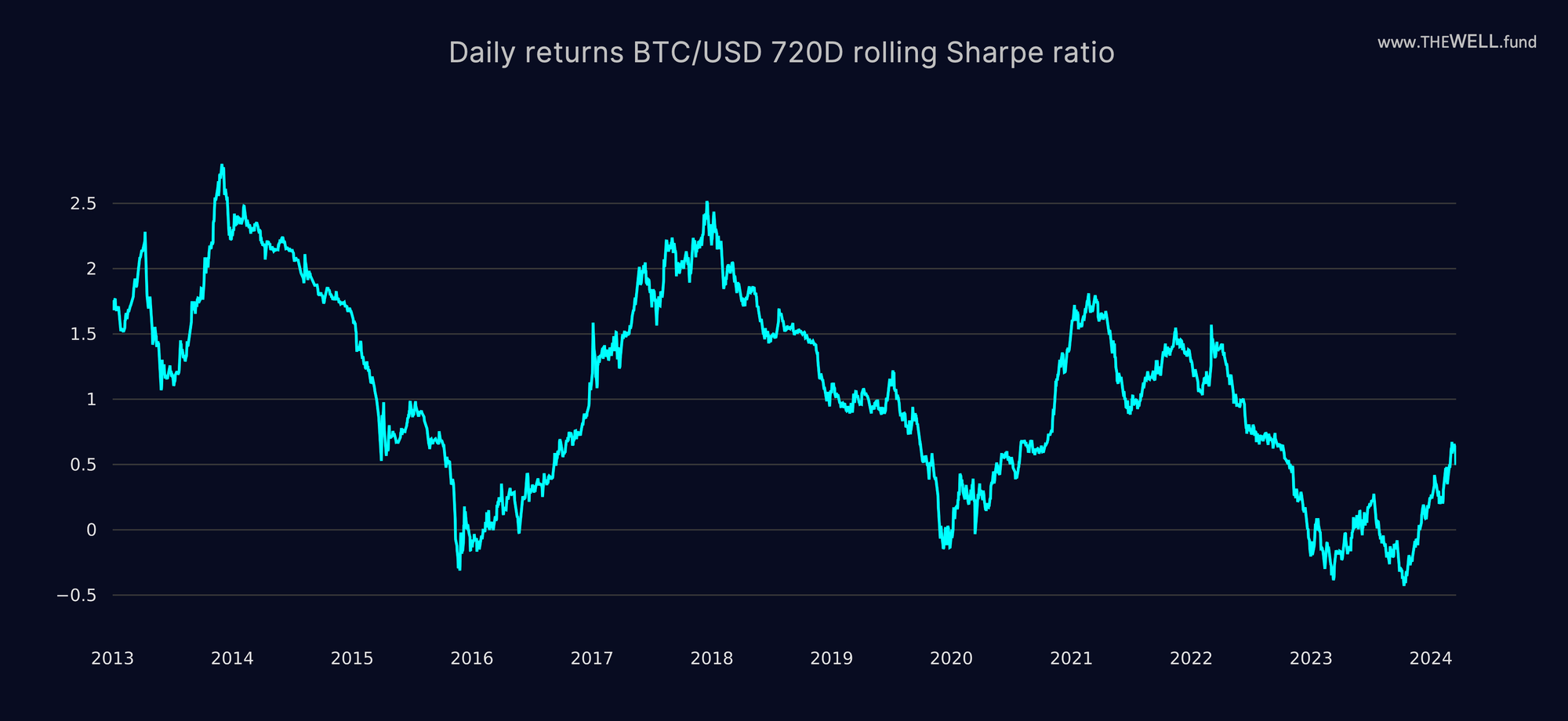

Over the last decade, crypto markets have proven to have unusually high positive absolute Sharpe ratios. In past bull markets, rallies in BTC have produced Sharpe ratios of up to 2.6.

This extremely favorable behavior is not always present in the markets, and periods with Sharpe ratios close or below 0 can occur. However, momentum funds get compensated greatly when the market regime favors convexity, such as during the current bull run.

In our opinion, the key advantage a crypto momentum fund offers is that investors can benefit from the fund’s strategies without having to try to market time the tops and trouble themselves with investment decisions during market corrections.

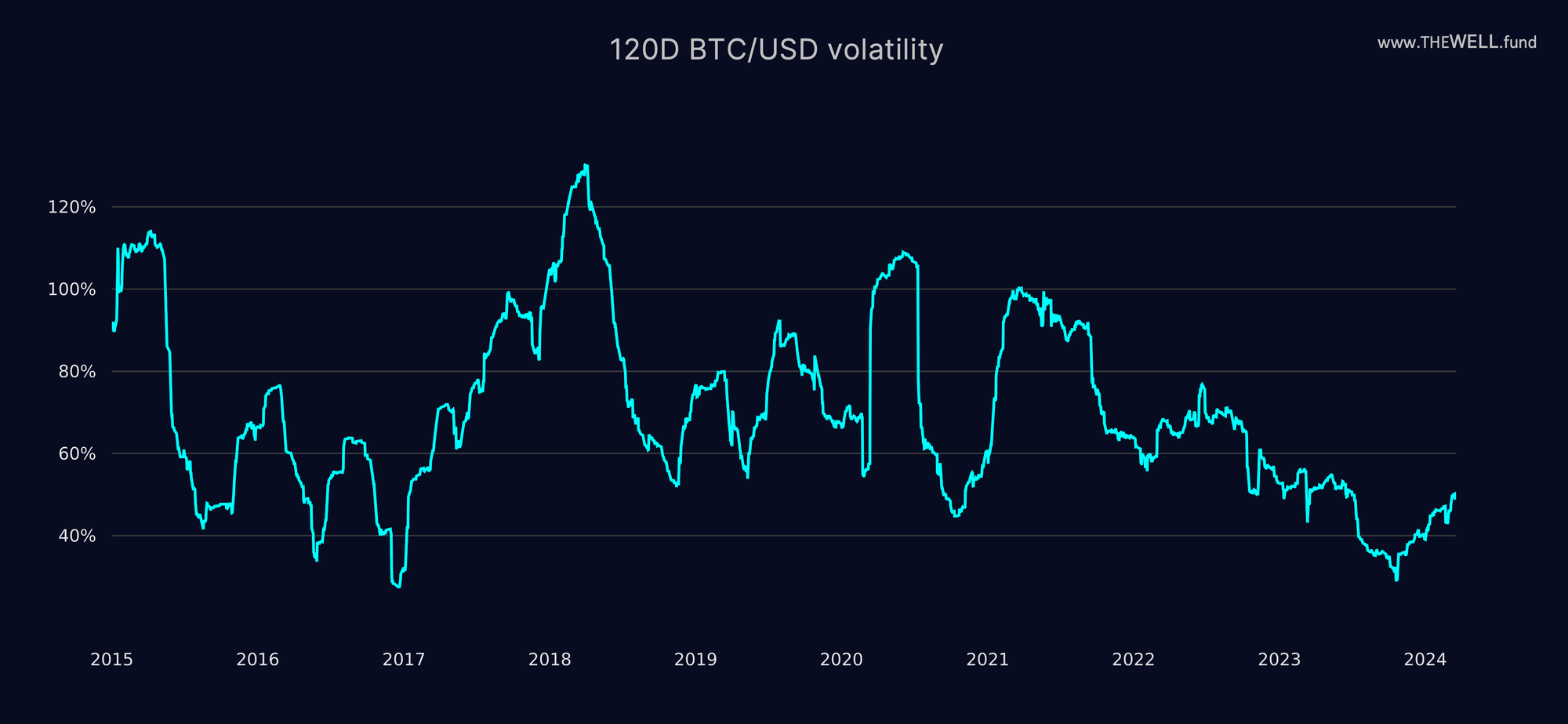

As can be seen in the above graph, volatility is trending up and may soon become overwhelming to deal with without a quantitative approach.

Since we shared a graphical insight into our models last month, the most likely path prediction came true, with Bitcoin rallying more than 40%. Most interestingly, the regimes that follow the one we are currently in, have historically been even more favorable for the asset class. This market data based prediction is additionally supported by our internal sentiment analysis models.

After facing a challenging trading environment last year, we believe, that convexity strategies are set to shine bright in 2024 and be among the very top performing quant strategies.

This blog post is shared with the intention to provide educational content, general market commentary or company specific announcements. It does not constitute an offer to sell or a solicitation of an offer to buy securities managed by The Well GP.

Any offer or solicitation may only be made pursuant to a confidential Private Placement Memorandum, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the fund.

Past performance is not necessarily indicative of or a guarantee of future results.

The Well GP makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal, tax advice or investment recommendations.

This publication may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward looking statements are based on the management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. Although the management believes that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these expectations will prove to be correct.