Established trends, catalysts and sudden surprises

During the last couple of weeks there has been a significant shift in market sentiment from being in a prolonged crypto-winter to signs of hope that we are entering a crypto-spring. (One of many references:

https://dailyhodl.com/2022/07/31/crypto-hedge-fund-veteran-mark-yusko-predicts-bitcoin-spring-kicks-off-btc-move-heres-his-timeline/)

The catalyst for many people seemed to be the upcoming Ethereum transition from proof-of-work (PoW) to proof-of-stake (PoS). Seasoned traders were rather skeptical, as usually the anticipation of an event is what moves prices and the event’s actual occurrence is mere exit liquidity.

The kick-off of the recent down move commenced with the bigger than anticipated CPI print in the US, raising doubts about the narrative that BTC is an inflation hedge. So far, resistance in the major coins and equity indices continues.

As a quantitative firm, a big advantage is, that narratives, events, and macro factors are only part of the equation, and a Bayesian view is formed by the models with significantly more input than a human brain can ever incorporate.

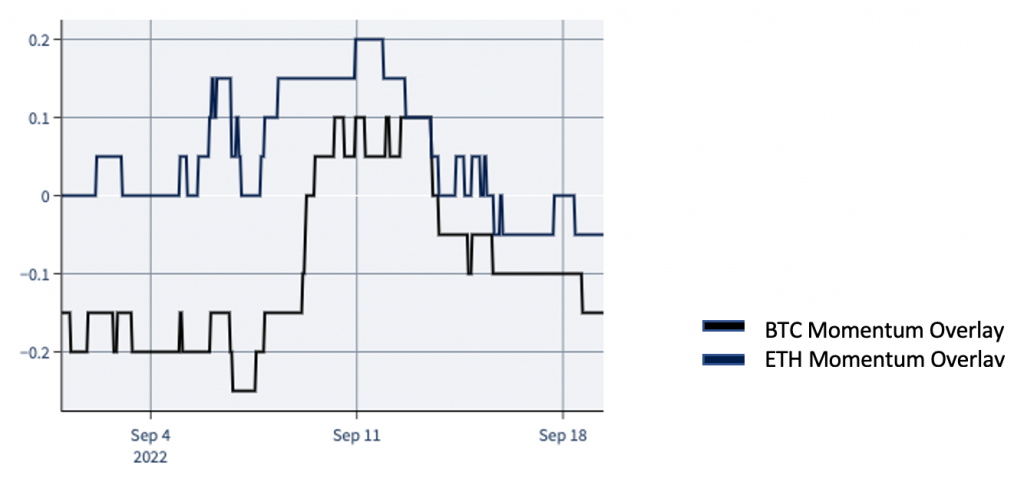

Our proprietary Momentum Overlay model was rather cautious during the last couple of weeks, as momentum might have been strong at times, but not enough confirmation followed to take on significant bets on the long- or short-side.

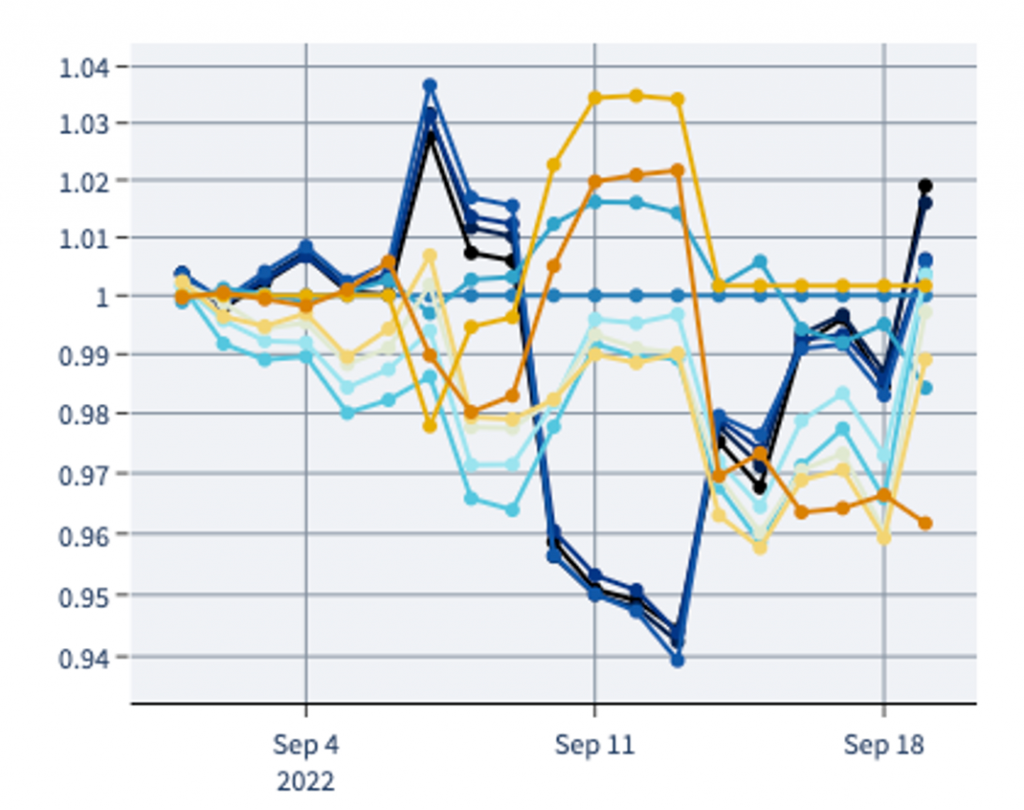

Various momentum measures on multiple timescales also provided an ambivalent picture that resulted in an almost neutral expectation for the market:

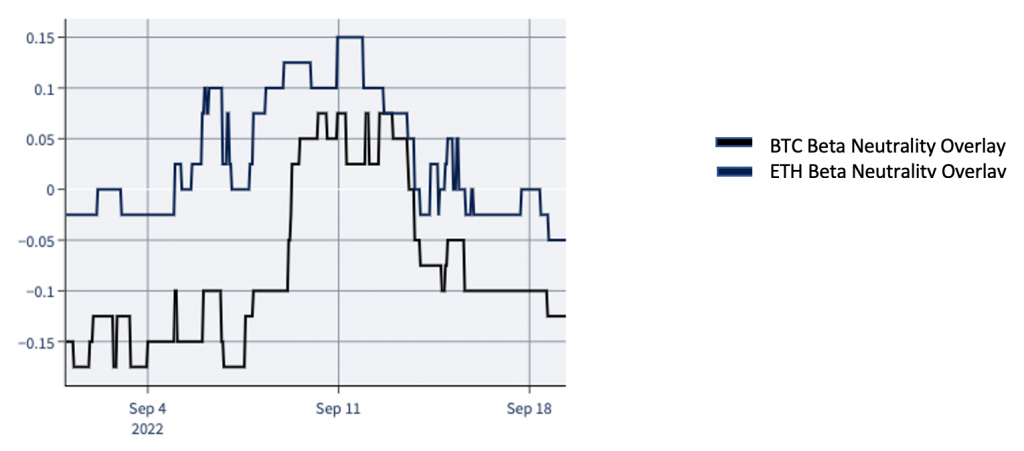

Interestingly, our measures for a beta neutral portfolio, that also incorporates Altcoins, ended up in almost the same weightings as our Momentum Overlay.

The key takeaway for us is the following: As exciting as the last couple of weeks have been, it seems that larger changes in the direction of more market dispersion are still absent. Our multi-strategy philosophy feels especially right in such environments, and we encourage everyone to reflect on the past to spot potential biases in expectations and assumptions.

Things might stay exciting.

The information presented above does not constitute an offer to sell or a solicitation of an offer to buy any securities associated with The Well US Feeder LP, a Delaware Limited Partnership or The Well Zero LP and The Well Cayman Feeder LP, both Cayman Islands exempted limited partnerships, together (“the Funds”).

Any offer or solicitation may only be made pursuant to a Confidential Private Placement Memorandum for each of the Funds, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the Funds.

The Funds make no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations.