Time-series Momentum vs. Cross-Sectional Momentum: It’s all relative

We often get asked if we include time-series or cross-sectional momentum in our strategies. As a reminder, time-series momentum is the momentum or trend an asset develops relative to its historical performance. For example, breaking out of a previous high. Cross-sectional momentum compares the performance of one asset against other assets and takes relative positions to each other. An example would be going long Tesla stock whilst shorting Porsche stock, if Tesla has had higher returns during the last 250 days.

We primarily incorporate time-series momentum into our strategies. One could assume that cross-sectional information is lost that way. We disagree and would like to provide nuance on how to interpret a signal by itself and apply it to overall portfolio construction. Cross-sectional momentum is already a self-sufficient portfolio construction mechanism. Long and short positions usually have the same notional amount, which results in a market/beta-neutral portfolio. A signal based on time-series momentum, on the other hand, has to be incorporated into a portfolio construction method like Markowitz originally intended. This opens a Pandora’s box of portfolio optimization problems, but simultaneously offers tremendous opportunities to generate far more favourable returns than the initial signal from the one time-series initially generated.

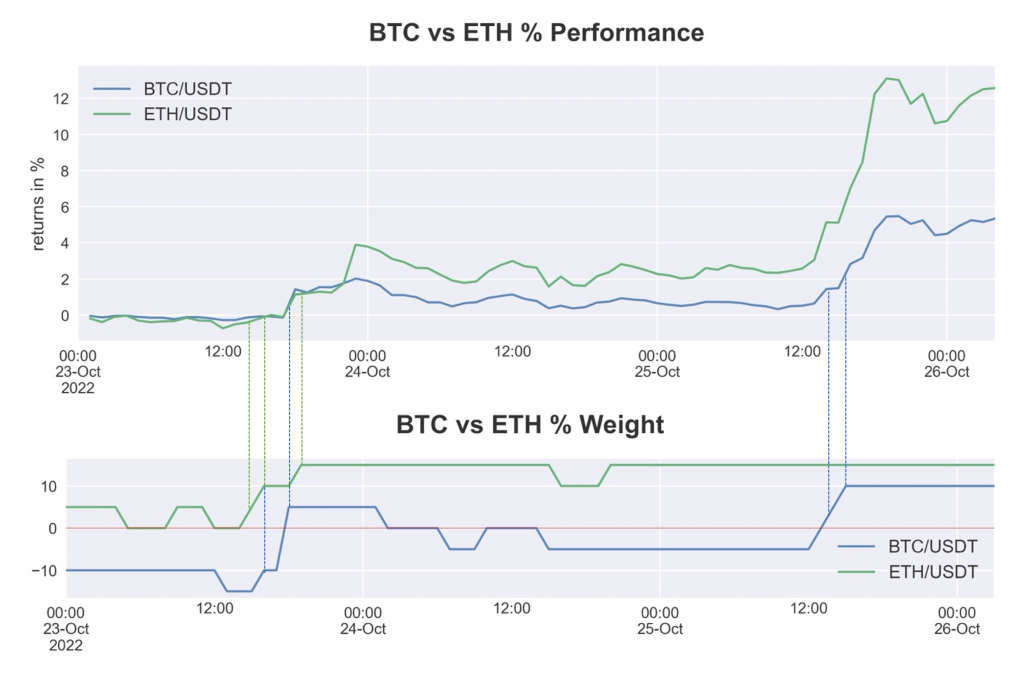

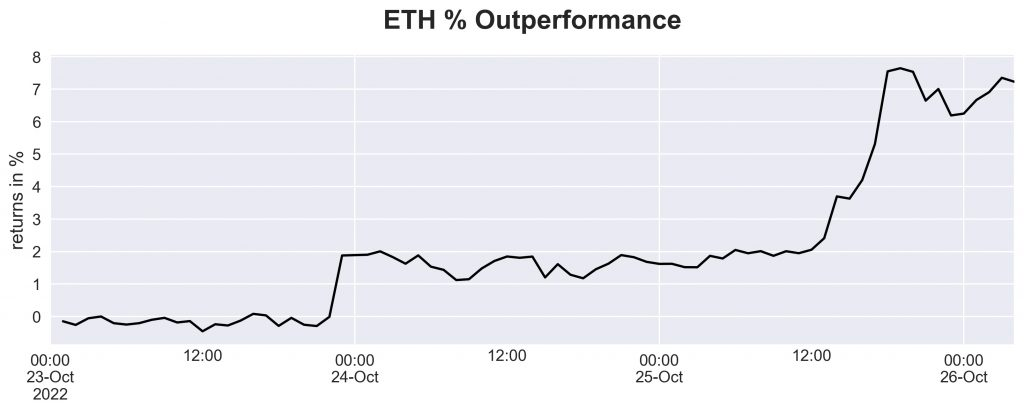

Here is a glimpse into our process, to highlight some of our experiences. Before yesterday's massive outperformance of BTC vs. ETH, our model based on time-series momentum was already anticipating that ETH had better properties in a portfolio combined of these two assets and positioned itself accordingly.

Our indicators picked up the relative outperformance almost exactly one day in advance and set up a highly profitable trade.

The outperformance of ETH vs. BTC was significant, and it is worth noting that picking up such behavioural patterns can have great benefits for the overall portfolio, as this kind of alpha is market-independent.

The properties used to weigh both assets were almost exclusively picked up by the portfolio construction method and it was primarily the signal that decided the direction of the trade. There are numerous portfolio construction methods and it's easy to get lost in all the techniques like agnostic risk parity, hierarchical risk parity, Markowitz and all the different methods of matrix cleaning like Ledoit-Wolf, rotational invariant estimations etc. We encourage any reader to rethink common narratives about time-series vs. cross-sectional momentum and dive deeper into alternative paths. And, maybe, sin a little and open the Pandora’s box. Just to see the excitement and feed your curiosity. You might like the world you find.

The information presented above does not constitute an offer to sell or a solicitation of an offer to buy any securities associated with The Well US Feeder LP, a Delaware Limited Partnership or The Well Zero LP and The Well Cayman Feeder LP, both Cayman Islands exempted limited partnerships, together (“the Funds”).

Any offer or solicitation may only be made pursuant to a Confidential Private Placement Memorandum for each of the Funds, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the Funds.

The Funds make no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations.