Unleashing the power of diversification with a market-timing cryptocurrency hedge fund

In light of the Wisconsin Pension Fund's recent decision to invest in Bitcoin (https://www.wpr.org/news/wisconsin-pension-fund-bitcoin), we would like to showcase the potential benefits of integrating a market timing cryptocurrency hedge fund into a traditional portfolio. A momentum fund like The Well offers the distinct advantage of market timing on behalf of the investor, allowing them to capitalize on the opportunities in the cryptocurrency markets without requiring a view on market movements.

Investment portfolios are designed to balance risk and return. One effective way to achieve this is through diversification, which involves spreading investments across various assets to mitigate the impact of market fluctuations in individual securities or sectors. The key to diversification's power lies in the mathematical principle that different returns can be combined, while volatility cannot. Instead, it can be offset across return streams. This means that, with optimal selection of diversified assets, strategies, or signals, the same or higher returns can be achieved with reduced downside risk.

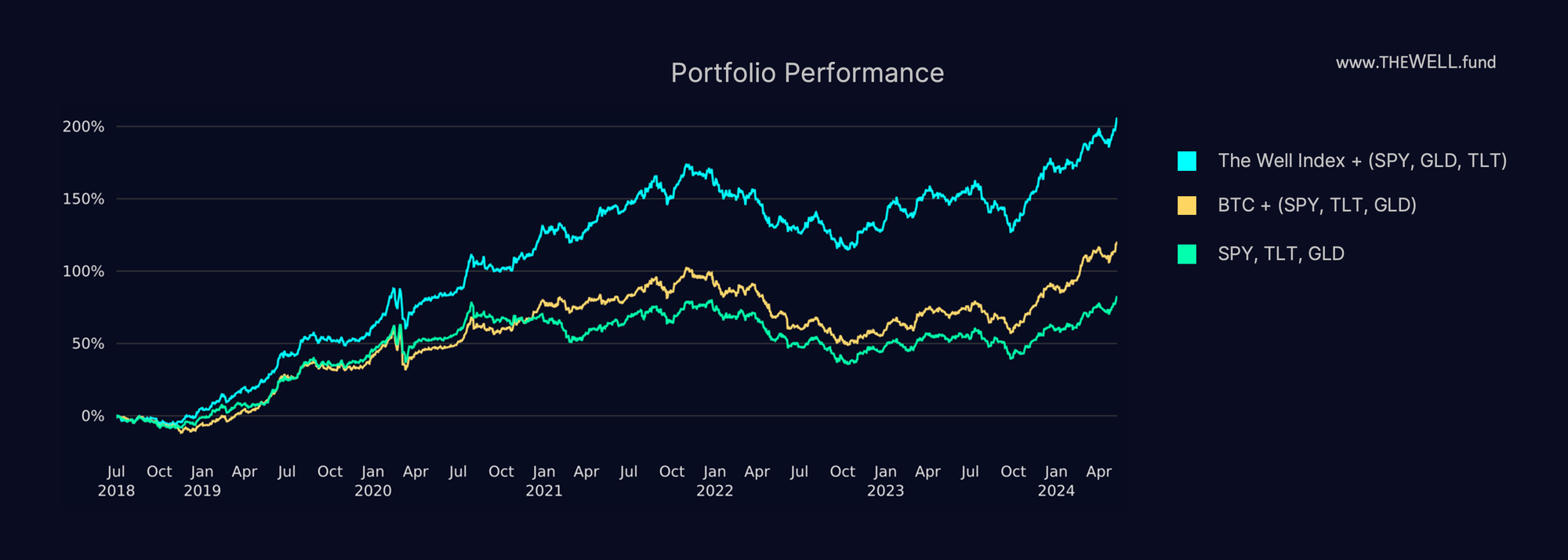

We will compare the advantages of combining Exchange-Traded Funds (ETFs) - which serve as proxies for equities (SPY), bonds (TLT), and gold (GLD) - with Bitcoin, against combining these assets with a crypto momentum hedge fund. For each scenario, we create a single portfolio to illustrate how adding these strategies enhances the results. Notably, our signals must consistently generate profits across all these asset classes before we incorporate them into our strategies.

In our example, we employ a portfolio weighting strategy known as Risk Parity, which assigns weights inversely proportional to each asset's volatility over a 260-trading-day lookback window. This approach ensures that assets with higher volatility receive less weight, thereby allowing the portfolio to potentially achieve a higher overall Sharpe Ratio. Additionally, we introduce a 10% annualized 90-day portfolio volatility target to ensure comparable drawdowns and returns. All data is based on a starting point of January 2013.

As you can see in the table below, BTC and equities already perform well in terms of Sharpe ratios, yet they experience periods where they suffer substantial drawdowns.

In the next table, you can see the effects of the combined portfolios.

The combination of traditional assets and Bitcoin already yields an attractive Sharpe ratio of 1.13. However, by replacing Bitcoin with a hedge fund that specializes in capturing momentum in the crypto markets, the Sharpe ratio increases to an impressive 1.37. This is a rare and exceptional level of performance typically only achieved by top-performing hedge funds during exceptional market conditions.

The impressive outcome can be attributed to the unique behaviour of the momentum hedge fund, which effectively diversifies the portfolio by contrasting with traditional assets. By staying out of the market during unfavourable periods, the momentum hedge fund avoids the large drawdowns typically experienced by Bitcoin, resulting in a more stable and resilient portfolio.

The data suggests that incorporating a momentum hedge fund into a portfolio is a more effective way to enhance returns than simply adding Bitcoin. This is evident even when using a basic Risk Parity approach to allocate portfolio weights. More advanced methods would further improve the portfolio's performance, highlighting the benefits of diversifying with crypto via a crypto momentum hedge fund.

BTC denominated SMAs: If you're looking for full beta exposure , combined with the potential for outsized returns on your BTC, we offer customized solutions and would be delighted to discuss how we can tailor a solution to meet your specific needs. Please don't hesitate to reach out to us.

This blog post is shared with the intention to provide educational content, general market commentary or company specific announcements. It does not constitute an offer to sell or a solicitation of an offer to buy securities managed by The Well GP.

Any offer or solicitation may only be made pursuant to a confidential Private Placement Memorandum, which will only be provided to qualified offerees and should be carefully reviewed by any such offerees for a comprehensive set of terms and provisions, including important disclosures of conflicts and risk factors associated with an investment in the fund.

Past performance is not necessarily indicative of or a guarantee of future results.

The Well GP makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal, tax advice or investment recommendations.

This publication may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward looking statements are based on the management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. Although the management believes that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these expectations will prove to be correct.